I have not done any hard core research into the success or growth track of companies following a successful Kickstarter, Indigogo or other crowdfund campaign.

But anecdotally, this is what I have observed. And this is definitely what I see in many startups, even ones that do not go the Kickstarter/crowdfund route.

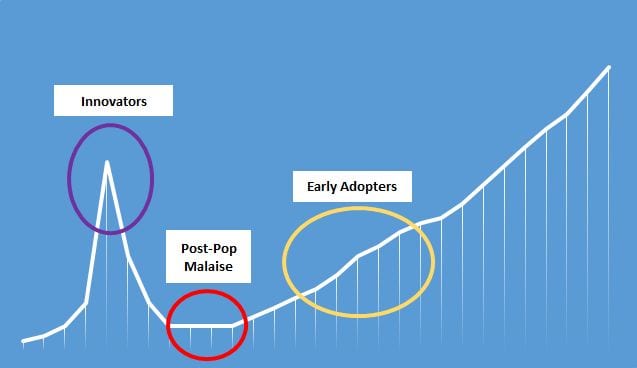

Take a look at the graph below, a rough approximation of growth I see.

A company comes out with a new product/service and sees a pop in their growth that comes from enthusiastic supporters – also called innovators when we look at in context of the classic product adoption curve.

That follows a defined deflation with a longer path to growth, if at all. Or, it could be a mild deflation off the initial top and settle into a range without any breakout on the upside. If there is growth, it is much slower and purchases from early adopters takes time.

What is going on in my experience is that the new company is getting its initial pop from its enthusiastic supporters or innovators in the category; it is selling on their emotions and tapping into their enthusiasm, but is never able to find its footing in appealing to the broader market that does not experience the same level of emotion or enthusiasm. This can lead to slow growth, no growth or a decline, all of which can lead to its demise.

Either the owners get tired, they are not able to raise more money, competitors come in and take over, or they just fail because of declining sales.

How does a company avoid this post-pop malaise?

I would argue that a company is better off understanding as early as possible how to appeal to the broader market. Instead of spending dollars to appeal to the innovators, spend to figure out who is the broader market (customer personas), how to sell to them (keywords, headlines, copy, marketing messages), and if they will actually purchase. The easy part is getting the innovators; the hard part is turning it into a real company with appeal to a broad enough market to power its growth and sustainability.

But, doesn’t early sales help generate cash flow? Well, maybe, but is it enough to help? Let’s take a look.

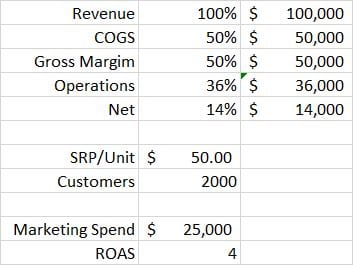

The worksheet copies below are just a real rough back-of-the napkin P&L to a successful crowdfund or innovator growth campaign.

Let’s say the product retails for $50, the marketing campaign costs $25K, and it nets 2000 customers, $100K in revenue, a net of $14K and an ROAS /MER(return on ad spend/marketing efficiency ratio) of 4. That is respectable, but not great. Great would be an ROAS OF 7 or more, which is really what you want when selling to innovators at this early stage.

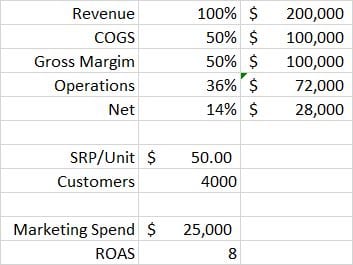

Let’s say ROAS is 8, which means revenue would be 200K, and net is $28K.

Whatever variables you want to use in the model, the end result is still not a lot of net income, and I am being generous when I only have COGS at 50% and operations at 36%. Those are usually higher for startups.

How far will that net income go to power more growth? Maybe not the far.

That is why you may be better off to figure out how to appeal to the broader market.

And when you have nailed that with positive metrics and solid ROAS, come back to do your innovator/crowdfund phase for some early revenue and then continue straight into going after the early adopter phase with your proven campaign that you tested out earlier.

Less loss in momentum from your successful crowdfund campaign and maybe even a heck of a lot better crowdfund results because you have previous learnings that you can apply.

Want to download the spreadsheet model in this post?