That’s my Vizsla, Zooka at 10-months old. He does not stop for anyone or anything, particularly when he is off-lead having a good time bounding through the snow.

The evolving consumer product retail landscape is like Zooka, not stopping for anyone or anything.

This post is summarizes the evolving state of resellers and retail and how consumer goods startups and small companies can best take advantage of it. Like most of my content that I try to keep current, I will do the same with this post.

Current landscape and trends

Big getting bigger

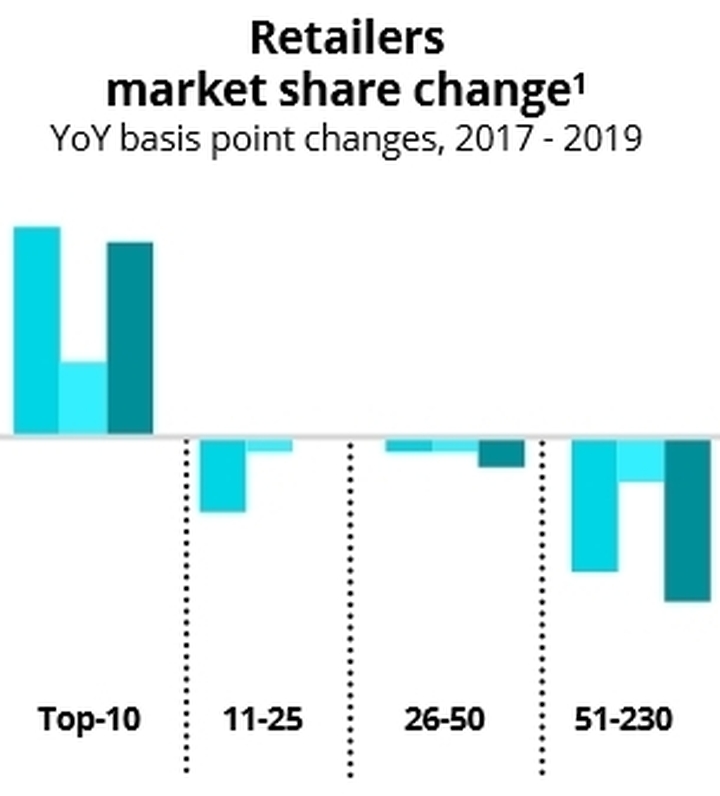

The big are getting bigger and offering more and more at lower and lower prices. As more consumers shop these large resellers, and more brands climb on board, its a self-reinforcing feedback loop.

Big resellers (examples include Costco, Sams, BJ’s, Wal Mart, Target, Meijer and Kroger), marketplace platforms (examples include Amazon, Wal Mart, Target, Kroger, Ebay, Etsy & Albertsons) and retail ecosystems (example is Amazon/Whole Foods Market/Amazon Go) started on volume and pricing but are now offering substantial selection and choice.

And among those in this group, it is really no longer about online versus offline, because most that were traditional offline now have fairly robust online operations.

Via Deloitte

Online penetration and growth

In the U.S. market it stands at 11%, whereas in China, it is 38%. There is probably significant growth ahead in the U.S. for online e-commerce.

While convenience attracts most first-time customers to online ordering, it has some limits in that online shoppers are citing a pain point of falling into a rut, especially with grocery, because of automated ordering of the same basket again and again. Some miss the sensory experience of shopping in person.

Discount vs luxury

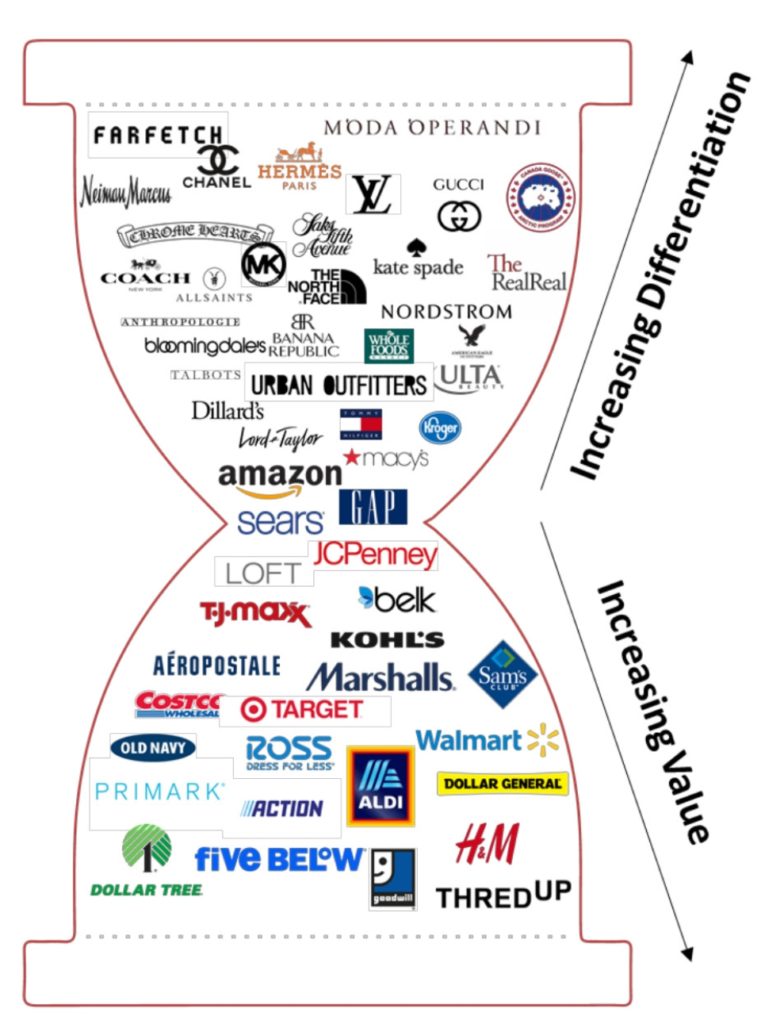

There is a bifurcation happening between lower quality/lower pricing/high volume versus high quality/high pricing/scarcity/luxury, with products and resellers that fit somewhere in the middle loosing ground.

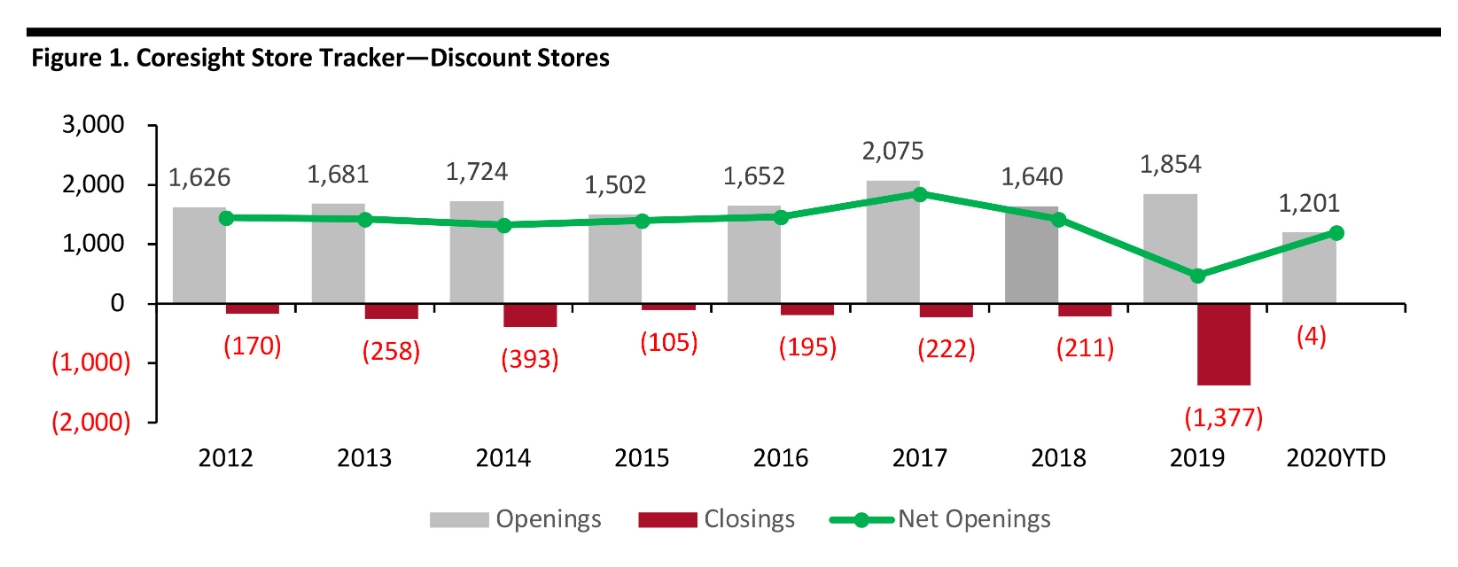

Via Coresight

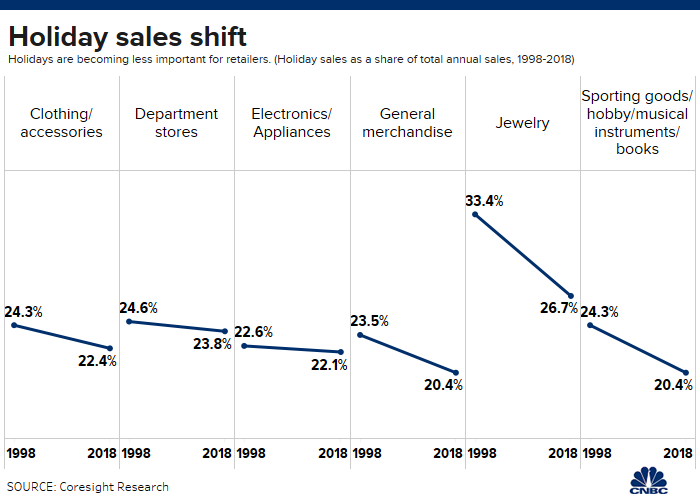

Shopping festivals and shopping holidays

They are likely to get bigger, just like big retailers are getting bigger. Amazon’s Prime Day, Alibaba’s Singles’ Day, the emerging Black Friday event in July in the U.S., and existing events such as Black Friday and Cyber Monday in November. Smaller resellers are piggybacking off of these events. Events like these and online shopping have made the year-end holiday period less important for retailers.

Via CNBC

Smaller Footprints and new store concepts (where is the retail apocalypse?)

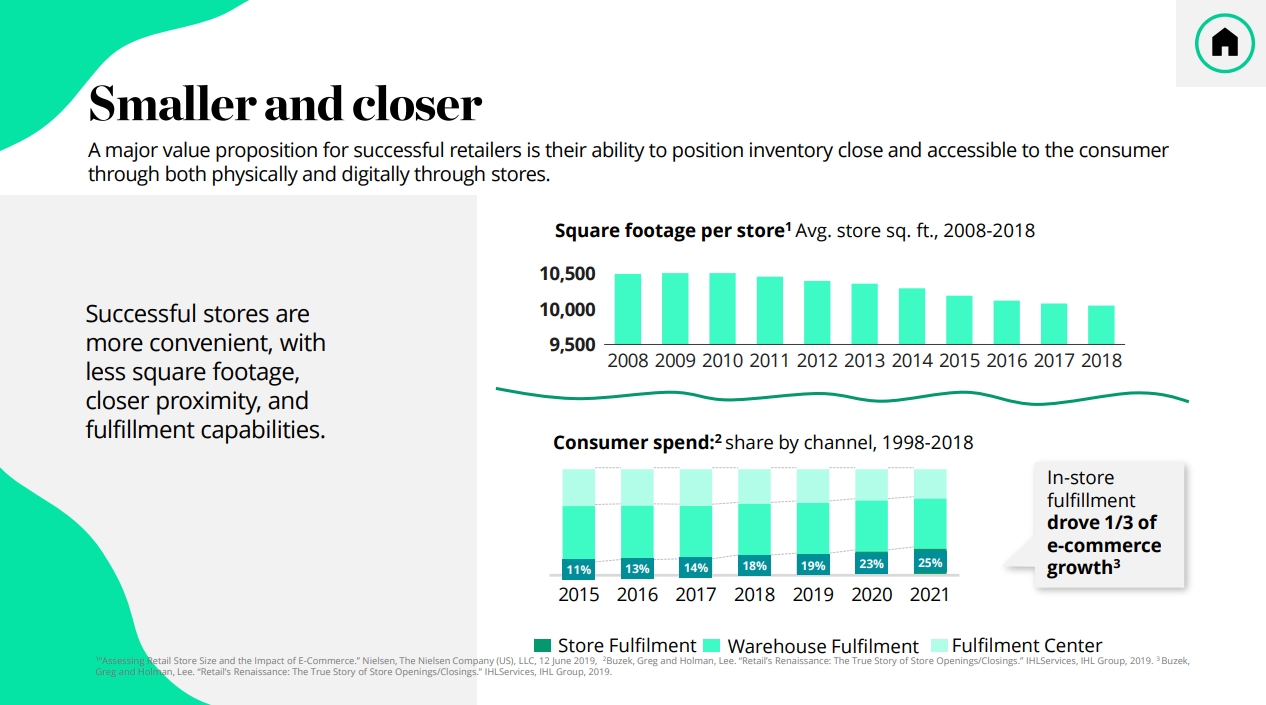

For every store that closes, 5 new ones open, and the trend is smaller stores closer to customers to increase convenience.

There is an apocalypse in certain segments, especially apparel and department stores, but overall offline growth is healthy and continues.

Look for new store concepts that offer more experiences, different visual displays and store layouts and ways to personalize products.

Via Deloitte

Technology and services

Technology and services being deployed:

- Ultra convenience with store locations and online ordering: buy in store, order online and pickup in store, order online for delivery, or deliver in 2-days, or same day;

- Cashier-less checkout;

- Free returns;

- Loyalty programs;

- Customer service;

- Omnichannel personalization of marketing and messaging and product offerings;

- On demand personalization and possibly 3D printing vi in-store kiosks for certain products;

Resellers as vendors and data scientists and increasing automation

We’ve already seen a boom in private label and that will continue.

They are also becoming more data centric and are using it in every aspect of their operation. It will continue to be used to drive selection of vendors and how vendor relationships are managed and how vendor products are sold. Data about vendor selection comes from existing sales in other channels or resellers and on platforms (i.e.: Amazon can use sale data on its marketplace to help make decisions about vendors in its retail locations).

Robotics and machine learning are leading to more automation in warehouses and in stores.

These initiatives require significant investment that not all can make.

Differentiate or Cease To Exist

Another problem I see is lack of differentiation, especially when it comes to products and pricing. There is less curation or discovery involved. If you don’t find what you want at one reseller, then another a block or click away has what you want.

Naturally what has happened is that consumers migrate to purchasing whoever can offer the cheapest price, which means the biggest resellers, marketplace platforms or retail ecosystems. And increasingly, with all the technology and services it enables being adopted by the largest players, there is less incentive for consumers to shop anywhere else.

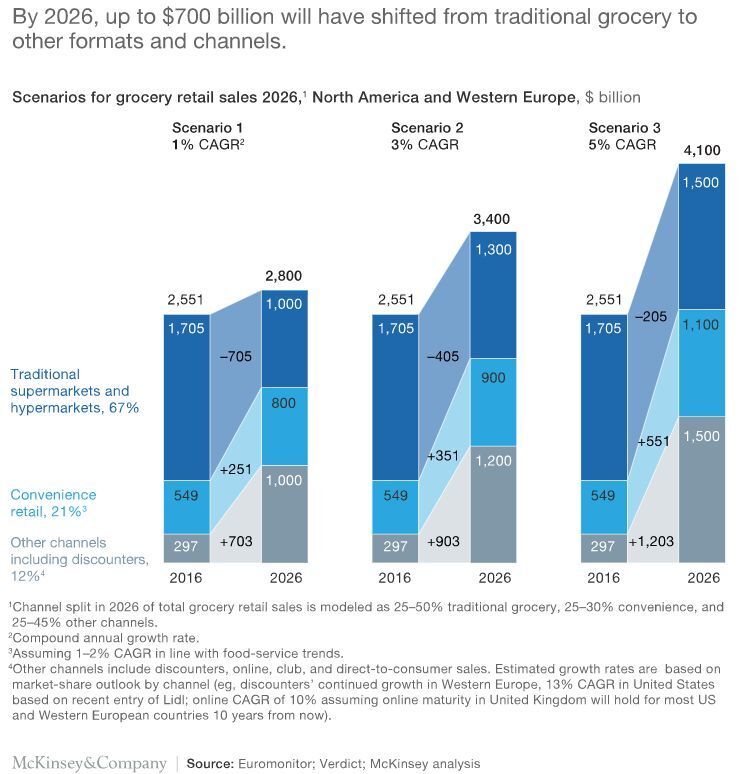

And that trend is expected to continue. Just in the grocery channel alone, it is estimated that by 2026, $700 billion in annual spend, or 41%, is expected to shift to online, supercenters, club and discount channels.

Via McKinsey

So on one end are price leaders and the other end is product differentiation, where resellers curate products. The middle is the squeeze and resellers must go in one direction or the other, unless they occupy the top spot already, in which case they can likely stay n the middle and thrive.

Via Coresight

Environmental concerns and sustainability

See apps emerge to help notify consumers to sell expiring items (already in Europe).

Services like Loop are partnering with consumer goods to recycle and reuse. Might that extend to in-store drop offs?

Exogenous Events

These are external events from the industry. Pandemics, weather events and trade disputes are on the rise, creating supply chain and pricing issues that are sure to create more stress, which will continue to support and possibly accelerate the death of many resellers.

What consumer goods startups and small companies can do

How does a startup or small consumer brand navigate this landscape.

Here are some thoughts.

Where do you fit? Hopefully not in the middle

Do you differentiate with low prices or by product benefits and features. Pick one direction or the other, but like retailers, if you are caught in the middle, you may get squeezed.

Innovate and differentiate

The obvious is to do your best to make and sell products that provide true points of differentiation that a consumer can clearly see within 2 seconds (what I call “WOW” products). It could be price but that is a tough place to be because someone bigger can usually come along and get more economies of scale and sell at a cheaper price.

Whatever area in which you choose to differentiate, make the products or the parts of your company that really matter to the consumer defensible so they cannot be copied.

Focus on niches, figure how to sell to them and own that segment

Really understand to whom you sell, why and own that niche. A $50 mm a year business (the space I like to play) is niche; even $100 million is still niche. You can be super niche and still do very well. In fact, I would say your goal is to be so good at knowing your customer and how to sell them that other companies would want to hire you as a consultant just to reach this target customer.

You can only really effectively learn this by selling direct-to-consumer, or at least through online platforms where you can at a minimum, capture the consumer’s vitals (email, phone, address) so you can do your own analysis through third party data appending.

And by selling direct, you can learn this stuff quickly, on the cheap, and you have a lot of flexibility to try new marketing, messaging, packaging, even product iterations. So even if you really do not want to sell direct as a core revenue generator strategy, just do it for testing.

Understanding the customer goes beyond the usual demographics and psychographics and personas. It is more about understanding the communities and tribes they belong to. Understanding how those communities and tribes work, what they believe, what they celebrate and what they denigrate helps to understand them and how your products and offering might be tailored to their needs and desires.

I would identify and understand these communities and tribes – niche markets if we want to call them – and build my offering (products, packaging, marketing, services, etc) to solve their problems or fill their desires. And I would get really good at that.

Make sure the niches you pick are growing.

Optimize packaging

There are more hops it is taking to reach the end consumer, especially out of its case packaging, so make sure it can’t get destroyed or look haggard in the logistics process.

Make it recyclable to prepare for services like Loop that allow customers to return used packaging to stores.

Make sure it presents well in augmented and virtual reality.

Create redundancy in the supply chain

Do risk scenario planning to shore up supply chain as best as possible. Dive into using artificial intelligence to help manage supply chain to optimize cost and delivery times.

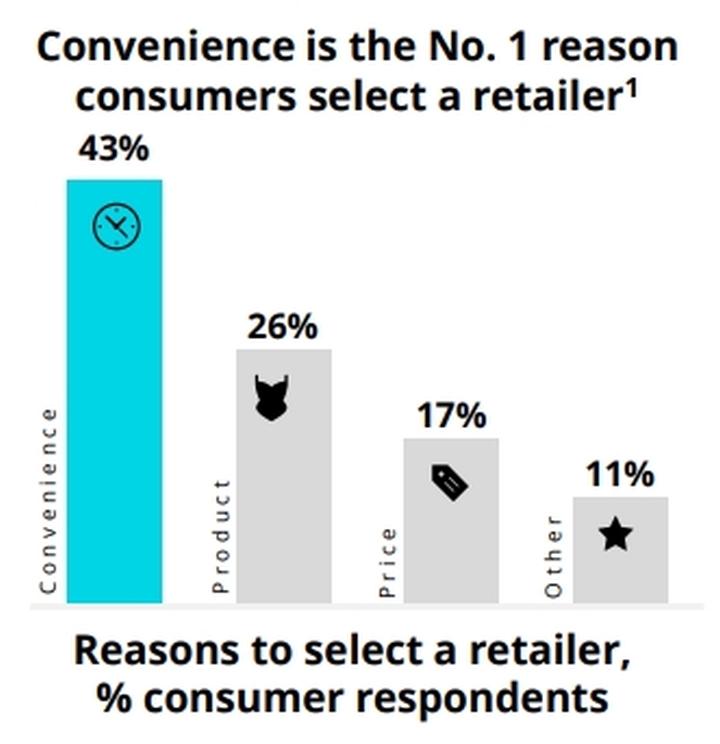

Selling to consumers is coming down to convenience

Successfully do the above but you still have to make it convenient and easy for them to buy. Unless you have such a blockbuster product without direct or substitute competitors, consumers won’t put up with the hassle if it is not convenient and easy for them to buy.

Via Deloitte

That means that you at least have to be well-represented selling on marketplace platforms (like Amazon) and be findable through SEO and relevant advertising on those platforms.

Pick resellers and retailers carefully

After that, there are going to be losers, especially if we believe the trends outlined above continuing.

You will have to research them carefully and understand:

- how they differentiate – along price, product curation, or something else, or , are they stuck in the middle getting squeezed?

- do they have a good growth strategy, are they financially viable over the long term and are they making investments to maintain or improve their differentiation?

- do they sell to your niche buyers, or are they trying to sell to your niche buyers (in which case you can help them do that through your product and your marketing)

The usual game plan is to sell in as many channels and resellers in each channel. I would say that it might be better to pick one in each channel and create a strong relationship with your category buyer and help them differentiate more with your products.

You might create more trust and gain better opportunities with that reseller than if you try to be everywhere. And if sales are forthcoming, you might be able to lower tradespend a bit.

Use your data that you collect selling direct and through marketplace platform to help your category buyer. They are arming themselves with data too, so you have to be prepared and bring your data to the table as well.

Geography matters

Be in resellers who are in high density population areas. Again , proximity to your niche market where they can conveniently find you or order your product for same day delivery.

Go big if you can

Get to the top reseller in your category, if you can, but you might not be able to get there. There is only so much shelf space that a top retailer can handle.