I work predominantly with small consumer companies, especially startups and a commonality I see among them is that their COGS is really high, and how COGS impacts a CPG company selling to retail is significant.

COGS includes raw materials, manufacturing, assembly and freight. This “Landed Cost” is the total cost of making the product and having it boxed up in a warehouse ready to ship to a retailer. It does not include packaging development costs, which are a marketing expense, and does not include the costs to ship from the warehouse to the retailer, which is an operating expense.

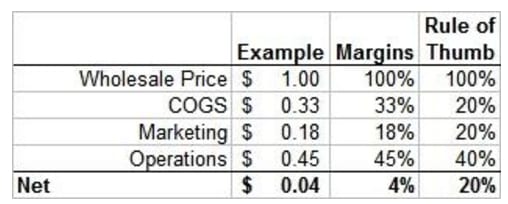

Take a look at this basic example:

The rule of thumb margins are for an established ongoing CPG business. The example includes an actual business, where wholesale price is the cost to the retailer and the gross revenue to the CPG company. Net includes the earnings before interest and taxes (EBIT).

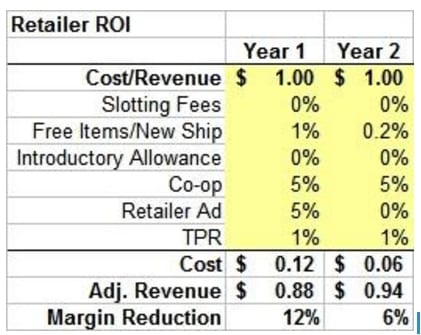

In this next table, we’re doing an ROI analysis of the year 1 and year 2 sales (projected) to a specific retailer, based on the terms they are offering. The fees are converted as a percentage of total projected sales and represent a true cost. As you can see, we don’t earn $1.00 on revenue, but it’s actually $.88 and .$94, respectively in years 1 and 2, for sales to that retailer.

Finally, in this last table, we pop in our revised adjusted revenue to see how it impacts net, especially if we hold our other expense buckets the same.

This is a very simplified example used for illustrative purposes only, so don’t use this for real. The reason is if your retailer fees change, it also changes your operating costs, which might also change your marketing costs. You have to do an ROI retailer analysis in the context of how it impacts your financials on a holistic level. The lesson here and the point of this article is that COGS really impacts your financials.

A few recommendations with respect to COGS:

- It’s OK to have a higher COGS when you are a start-up, but you must have a path towards reducing those costs. The lower the better, but shoot for 30%, which is very hard to achieve in the organic/natural food space unless you are doing some real volume.

- Raise your cost to retailers. That’s really hard to do, unless you can demonstrate rising raw material costs, because the retailer will likely pass that on to consumers and that will likely hurt sales. Its better to start out with as high a cost as possible to the retailer. Conduct thorough category/competitor research and develop your product so that it has high value to your consumers. This gives you room to charge a higher price.

- You could reduce your pack size, but not drop the cost and suggested retail price by an equal amount. In essence, you are fooling the consumer. Consumers are generally adept at price shenanigans and this will hurt your brand.

Based on these recommendations, it’s clearly better to understand where and how you will reduce your COGS over time and make sure that you lead into the retailer with the right price and pack size.